ANTIMONY

A Critical Mineral for Modern Applications

Introduction to Antimony

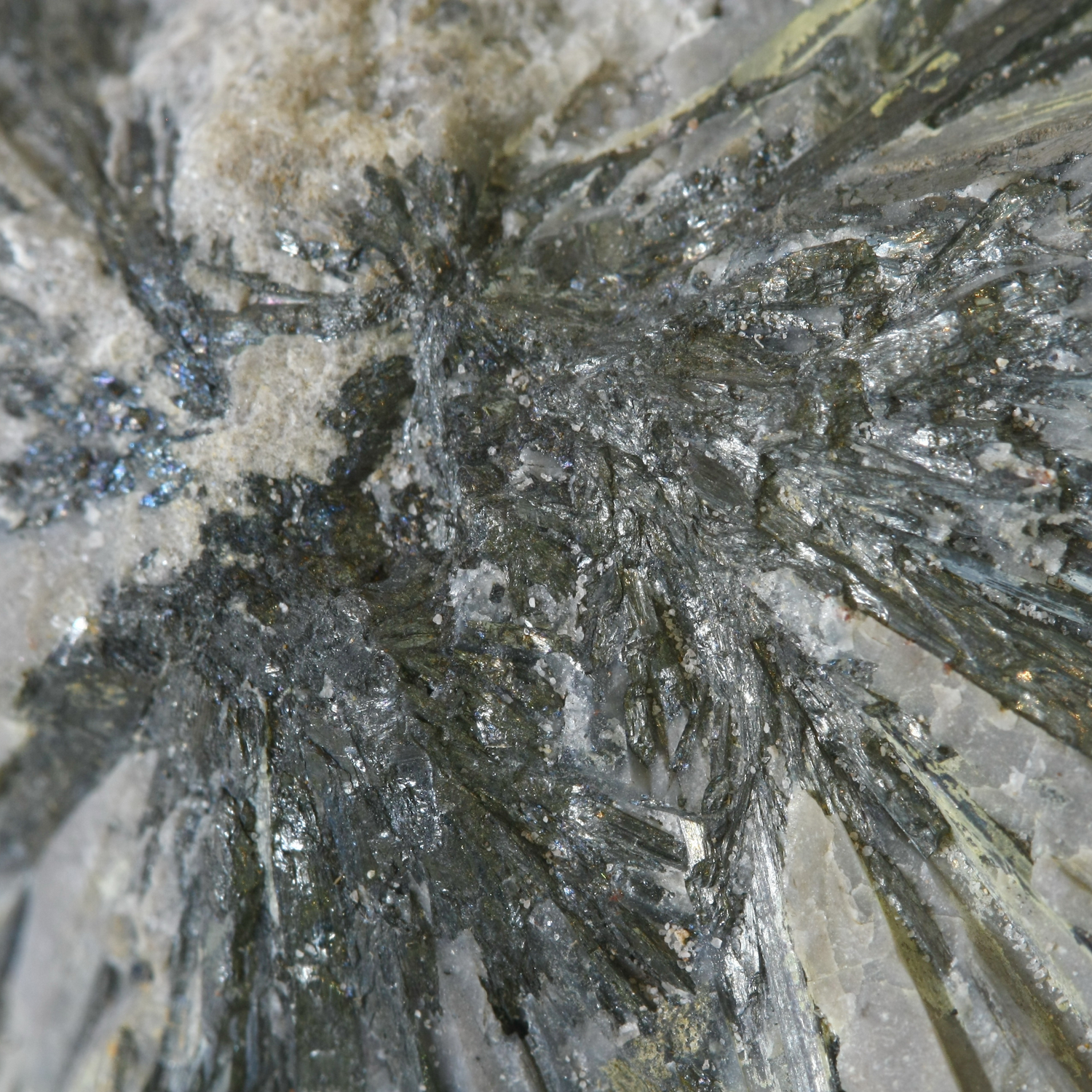

Antimony (Sb), with atomic number 51, is a lustrous gray metalloid known for its hardness and brittleness. Historically utilized since ancient times, antimony has found applications in various industries due to its unique properties. In recent years, it has been recognized as a critical mineral essential for modern technology and defense applications.

Geological Occurrence & Sources

Antimony is primarily found in nature as the sulfide mineral stibnite (Sb₂S₃). It also occurs in oxide forms such as valentinite and senarmontite.

Major Global Sources:

- China: The leading producer, accounting for approximately half of the world’s antimony production.

- Russia: A significant contributor to global supply.

- Tajikistan: Notable for its substantial antimony reserves.

- Bolivia: Holds about a fifth of the world’s estimated antimony reserves.

Industrial Uses & Applications

Antimony’s versatility makes it valuable across various sectors:

Flame Retardants:

- Used in combination with halogenated compounds to enhance flame resistance in textiles, plastics, and electronics.

Lead-Acid Batteries:

- Alloyed with lead to improve plate strength and corrosion resistance in batteries.

Semiconductors:

- Employed in the production of diodes and infrared detectors due to its semiconducting properties.

Ammunition and Military Equipment:

- Utilized in the manufacture of bullets and military hardware, contributing to hardness and durability.

Solar Panels:

- Incorporated in photovoltaic technologies to enhance efficiency.

Market Outlook & Growth Trends

Current Market Size & Demand:

The global antimony market was valued at approximately USD 2.17 billion in 2023 and is projected to reach USD 3.30 billion by 2030, exhibiting a CAGR of 6.1% during the forecast period.

(Source: https://www.grandviewresearch.com/industry-analysis/antimony-market)

Key Factors Influencing Growth:

- Rising Demand in Flame Retardants: Increased safety regulations are driving the use of antimony-based flame retardants in various industries.

- Growth in the Electronics Sector: The expanding electronics industry fuels demand for antimony in semiconductors and other components.

- Strategic Importance: Antimony’s role in defense and renewable energy technologies underscores its critical status.

Supply Chain Considerations:

Recent export restrictions by major producers, particularly China, have heightened concerns over supply security, leading to increased interest in developing alternative sources.

Notable Companies & Projects

Leading Companies:

- Hsikwangshan Twinkling Star Co. Ltd: A prominent Chinese antimony producer.

- Yunnan Muli Antimony Industry Co. Ltd: Another key player in China’s antimony industry.

- United States Antimony Corporation (USAC): Operates the only significant antimony smelter in the U.S.

Key Projects:

- Stibnite Gold Project (Idaho, USA): Managed by Perpetua Resources, this project aims to supply approximately 35% of U.S. antimony demand upon reaching full production.

- Nagambie Antimony-Gold Project (Australia): Operated by Nagambie Resources, focusing on antimony and gold extraction.

Quantum Critical Metals’ Antimony Projects

At Quantum Critical Metals, we are committed to exploring and developing domestic sources of antimony to enhance North American supply chain security.

Victory Antimony Project (British Columbia):

- Location: Situated on Graham Island in Haida Gwaii, approximately 2.5 kilometers north of Armory Mining’s Riley Creek Antimony Property.

- Project Expansion: Recently increased to 1,387 hectares due to favorable geological indicators.

- Historical Findings: Initial discoveries in 1988 identified significant antimony mineralization, with samples assaying up to 1.24% antimony.

- Exploration Strategy: Plans include detailed geological mapping, geochemical sampling, and geophysical surveys to delineate drill targets and assess the project’s full potential.

Future Potential & Investment Considerations

The strategic importance of antimony in defense, electronics, and renewable energy sectors presents significant investment opportunities. Developing domestic sources is crucial to mitigate supply chain risks associated with geopolitical tensions and export restrictions.